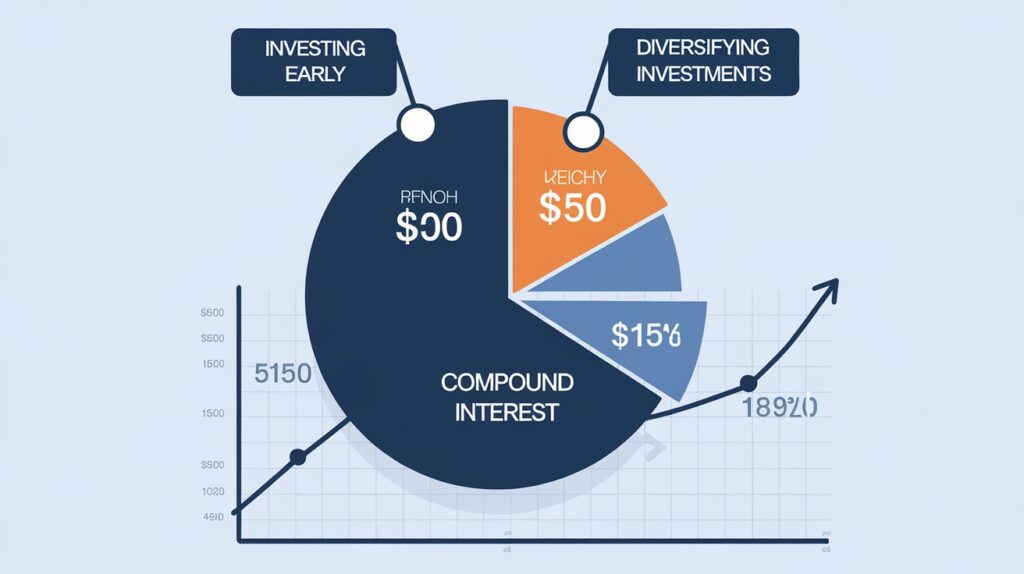

Diversification is a fundamental principle of investing that involves spreading investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from significant losses while still pursuing growth opportunities.

Why Diversification Matters

- Risk Reduction: Different asset classes (stocks, bonds, real estate, etc.) often perform differently under various market conditions. By diversifying, you can mitigate the impact of a poor-performing asset on your overall portfolio.

- Volatility Management: A diversified portfolio tends to exhibit lower volatility compared to a concentrated one. This stability can be particularly important for investors who are risk-averse or nearing retirement.

- Access to Multiple Opportunities: Diversification allows investors to benefit from various market segments and sectors, increasing the likelihood of capturing gains from multiple sources.

How to Diversify Your Portfolio

- Asset Allocation: Determine an appropriate mix of asset classes based on your investment goals, risk tolerance, and time horizon. For instance, younger investors may favor stocks for growth, while retirees might prioritize bonds for income.

- Sector and Geographic Diversification: Invest across different sectors (technology, healthcare, consumer goods) and geographical regions (domestic and international markets) to reduce exposure to specific risks.

- Utilize Mutual Funds and ETFs: Consider investing in mutual funds or exchange-traded funds (ETFs) that provide built-in diversification by pooling investments across multiple securities.

Common Misconceptions

- Diversification Guarantees Safety: While diversification can reduce risk, it does not eliminate it entirely. Market downturns can still impact a diversified portfolio.

- More Investments Equal More Diversification: Simply holding a large number of stocks does not guarantee effective diversification. It’s crucial to ensure that the investments are not correlated.

By implementing a thoughtful diversification strategy, investors can better navigate market fluctuations and pursue long-term financial goals.